18th Edition Amendment 1 and EV regulations

On February 3rd 2020 Amendment 1 of the 18th Edition of BS7671 was released. This amendment purely deals with Electric Vehicle charging points to reflect the changes in technology.

The key change is that if the charger meets the requirements in Amendment 1 there is no longer a requirement to install a separate earth electrode when installing the device into an installation utilising a TN-C-S supply.

The requirements of Amendment 1 will only apply to installations completed after the 31st of July 2020. Amendment 1 is available for free viewing at the IET’s website.

The IET publication ‘Code of Practice for Electric Vehicle Charging Equipment Installation’ is the IET’s official guidance on how to meet the requirements of BS7671 with regards to vehicle charging points.

The IET are planning to publish an updated version of the guide in line with amendment one in March 2020. Similar to Guidance Note 3 for inspection and testing, the code of practice looks in detail at the requirements of the regulations and how to meet them.

Current State and looking forward

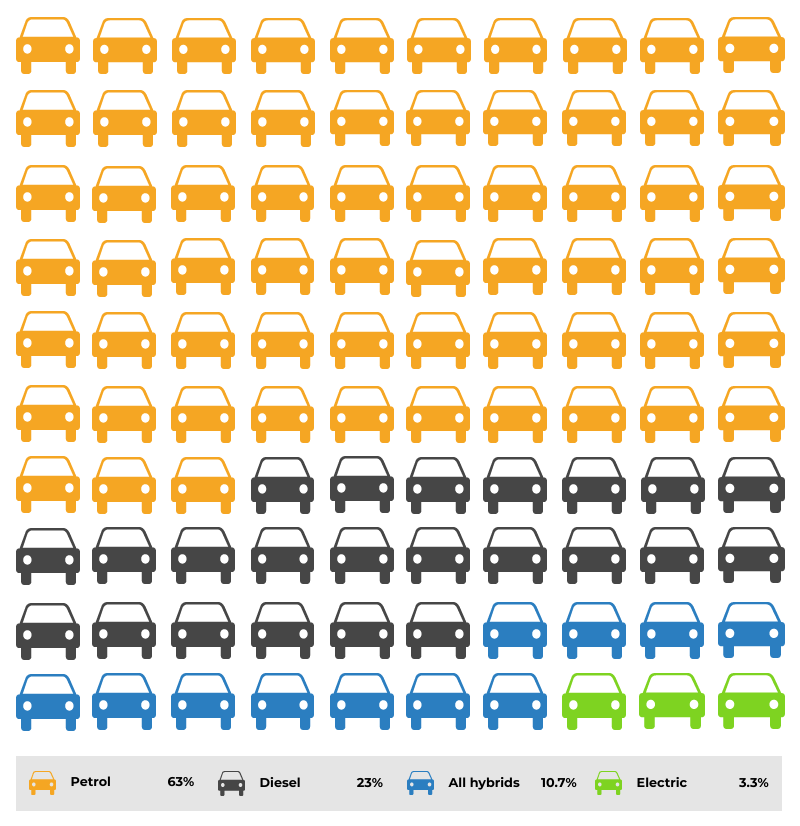

Electric Vehicles (EV) are slowly gaining a foothold in the UK new car market. In 2019, EV share of the market rose to 3.3 % up from 1.1% in 2018, whilst still small in relation to the overall market, it is still a considerable jump. The below chart shows the current market share for each type of vehicle in 2019.

The current bestselling pure electric vehicle in the UK is currently the Tesla’s Model 3.

credit | license

credit | license

This has taken over from the previous best seller the Renault Zoe.

Major car manufacturers are planning to release their first dedicated electric only models in 2020 with the release of the Volkswagen Audi Group VW id3, Audi e-tron and Skoda Citgo-e IV, the Vauxhall Corsa-e, Peugeot e-208, MINI’s Mini Electric and Smarts EQ Fortwo and EQ Forfour amongst others, effectively more than doubling the currently available model choice out there.

Credit | license

Credit | license

© M 93 / Wikimedia Commons /

© M 93 / Wikimedia Commons /

With this increase in variety in not only model choice but also price bands across the market the EV market is set to expand dramatically over the next few years.

Ban on sale of Petrol and Diesels

At the beginning of February 2020, the UK government announced that they were bringing forward ban on diesel or petrol powered vehicles from 2040 to 2035. This has the potential to cause huge ramifications in both the vehicle manufacturing industry and the EV charging point infrastructure.

It’s estimated that the UK will need 25 million chargers installed by 2050, which would mean that starting from now, 1 million a year would need to be installed. This covers all types of locations that will require a charging point of some type and both the car manufacturing industry and the grid operators are questioning whether this is feasible.

Whilst there is no confirmed date as of yet, it also worth noting that the government grant for purchasing a new EV will be withdrawn at some point. It has already been withdrawn for plug in hybrid models that don’t meet the current criteria. The grant currently allows for 30% up to £3500 of the cost of the vehicle to be subsidised by the government. This has the potential to initially impact the sale of new EVs.

However, from April 2020 savings on the Benefit in Kind tax that affect company cars will come in to effect. Aimed to incentivise the take up of electric vehicles, battery only powered cars will have company car tax rate of 0% in 2020-21, 1% in 2021-22 and 2% in 2022-23. This compares to a 16% tax rate currently. A typical petrol powered hatchback will have a tax rate of 27% in comparison in 2021.

This reduction in tax rate, along with the fact that 50% of new car registrations are company cars, should mean that any down turn in sales due to the removal of the government grant for private sales shouldn’t be noticeable.

Back to blog