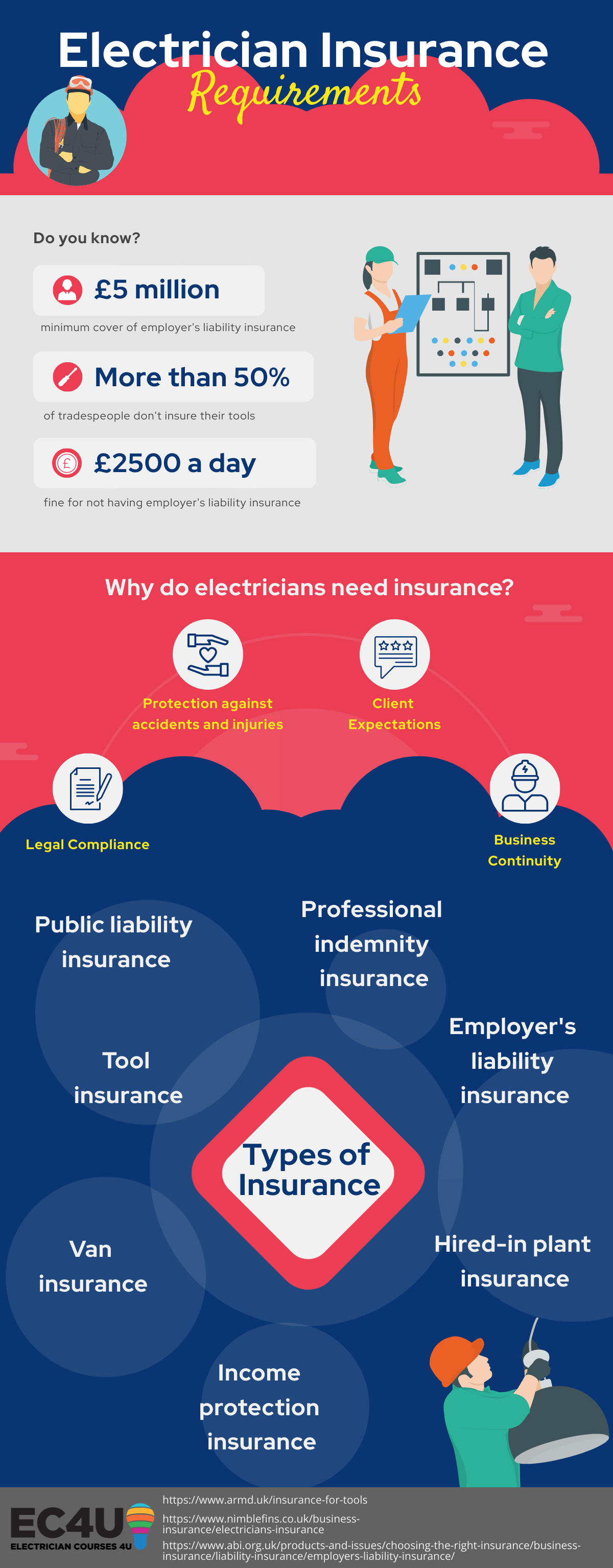

Electrician Insurance Requirements

Working as an electrician can be a rewarding and fulfilling career full of interesting projects and challenges. Whether it’s installing wiring, repairing electrical systems or carrying out maintenance work, electricians play a crucial role in ensuring the safety and functionality of various properties. However, the work carries a lot of responsibility and can be potentially dangerous, so it’s essential that electricians protect themselves against any risks and liabilities that may arise. This is where electrician insurance comes in.

All electricians, from sole traders to owners of large electrical installation businesses, must be insured to ensure legal compliance. This is the bare minimum requirement, however, and there are lots of other important reasons to make sure you, your employees, your equipment and your work are adequately protected.

In this article, we’re going to take a look at what electrician insurance is and why it’s essential, before delving into the different types of cover that an electrician may need.

What is electrician insurance?

Electrician insurance is a set of policies to safeguard electricians and their businesses from financial losses or legal liabilities. Not all of them are exclusive to electricians; in fact, many of these policy types are suitable for a variety of different scenarios, and are particularly useful for those who are self employed. However, some providers do offer electrician insurance that is specifically tailored to the unique risks and challenges faced by electricians in their day-to-day operations.

Why does an electrician need insurance?

Electrician insurance is a fundamental aspect of any responsible electrician’s business. Having the right insurance cover offers peace of mind and financial security, ensuring that electrical contractors can focus on their work without worrying about unforeseen events.

The electrical trade involves inherent risks, and even with utmost care and professionalism, accidents can happen. Property damage, worker injury or legal claims are just some of the consequences that can be financially devastating for an electrician and their business.

While the ongoing cost of regular insurance premiums may feel off putting, particularly to contractors who may not always be able to rely on a regular income stream, investing in appropriate insurance can help you to save hundreds or thousands of pounds further down the line. Here are some key reasons why electricians need insurance.

Legal compliance

In the UK, electricians employing staff are legally required to have employers’ liability insurance to protect their workers. Failing to have the necessary insurance in place can result in severe fines and legal consequences, and could even lead to the closure of the business.

Protection against accidents and injuries

Electricians work with hazardous equipment and are often exposed to dangerous situations. Accidents resulting in bodily injury or property damage can lead to costly compensation claims, which many small businesses wouldn’t be able to afford without insurance. By taking out insurance, electricians can rest assured that they won’t be burdened with substantial financial losses in the event of an accident.

Client expectations

Clients hiring electricians for their projects expect them to have adequate insurance coverage. Being insured demonstrates professionalism and a commitment to ensuring your clients’ safety and peace of mind. It can also be a deciding factor in securing contracts over competitors without these additional levels of insurance.

Business continuity

In the event of a liability claim, insurance can provide the financial support needed to keep your business running smoothly. It can cover the costs of repairs, legal fees and other expenses, preventing the business from going bankrupt. This is especially important for sole traders, who are personally liable for any business debts.

What types of insurance does an electrician need?

There are various different types of cover available, each of which has its own benefits. It’s therefore important to take out a combination of insurance policies to ensure comprehensive protection. While the specific insurance needs may vary based on the size and nature of the business, some essential types of insurance for electricians include:

Public liability insurance

Public liability insurance is one of the most crucial types of cover for electricians. It protects against claims made by third parties, such as clients, visitors, or members of the public, who suffer injury or property damage where the electrician is at fault. For instance, if a client trips over an electrician’s equipment and gets injured, or if the client accidentally damages the client’s property during electrical work, public liability insurance can provide the necessary financial cover for a payout.

Professional indemnity insurance

Professional indemnity insurance is essential for electricians who offer advice or consultancy services to clients. It protects against claims arising from alleged negligence, errors, or omissions in the advice or services provided. For example, if an electrician provides incorrect advice that results in financial losses for the client, professional indemnity insurance can cover the cost of legal defence and any resulting damages.

Income protection insurance

Income protection insurance is designed to support an electrician financially in case they’re unable to work due to illness or injury. It provides a regular income, typically a percentage of their usual earnings, during the period of incapacity, which allows them to meet their financial obligations and maintain their standard of living. This is especially important for contractors and sole traders, who don’t have the benefits of a regular employment contract, such as Statutory Sick Pay.

Employer’s liability insurance

Employer’s liability insurance is a legal requirement in the UK for electricians who employ staff. This insurance provides cover if an employee suffers a work-related injury or illness and makes a claim against the employer. It covers the cost of compensation and legal fees, protecting both the employees and the business. If you’re caught without employer’s liability insurance, you could be fined £2,500 per day.

Van insurance

Many electricians rely on a van to get themselves and their equipment to job sites, and wouldn’t be able to carry out their business without it. Van insurance is therefore vital, providing cover against theft, accidents, and other damage that could put the business out of action. Additionally, some policies also cover any tools and equipment kept in the van, protecting valuable assets that are also essential to everyday operations.

Tool insurance

Electricians use a wide variety of tools and equipment to perform their work, many of which are expensive or used on a daily basis and therefore necessary for business to continue. Tool insurance offers protection against the loss, theft, or damage of these valuable tools, ensuring that an electrician can quickly replace them without significant financial strain.

Hired-in plant insurance

Electricians occasionally need to hire specialised equipment or machinery for certain projects, and they are liable for any loss or damage caused to this equipment. Hired-in plant insurance covers the cost of repairs or replacements for rented equipment, reducing the financial burden for electricians.

Thinking about training to become an electrician? Take a look at our range of electrical courses.